7004 Extension Due Date 2025. The due date will be on 15 every year. 6 months (to september 16, 2025) for forms 1065, us return of partnership income and 1120s, us income tax return for.

Irs form 7004 extends the filing deadline for another: Generally, april 15th is the deadline for taxpayers filing for the calendar year.

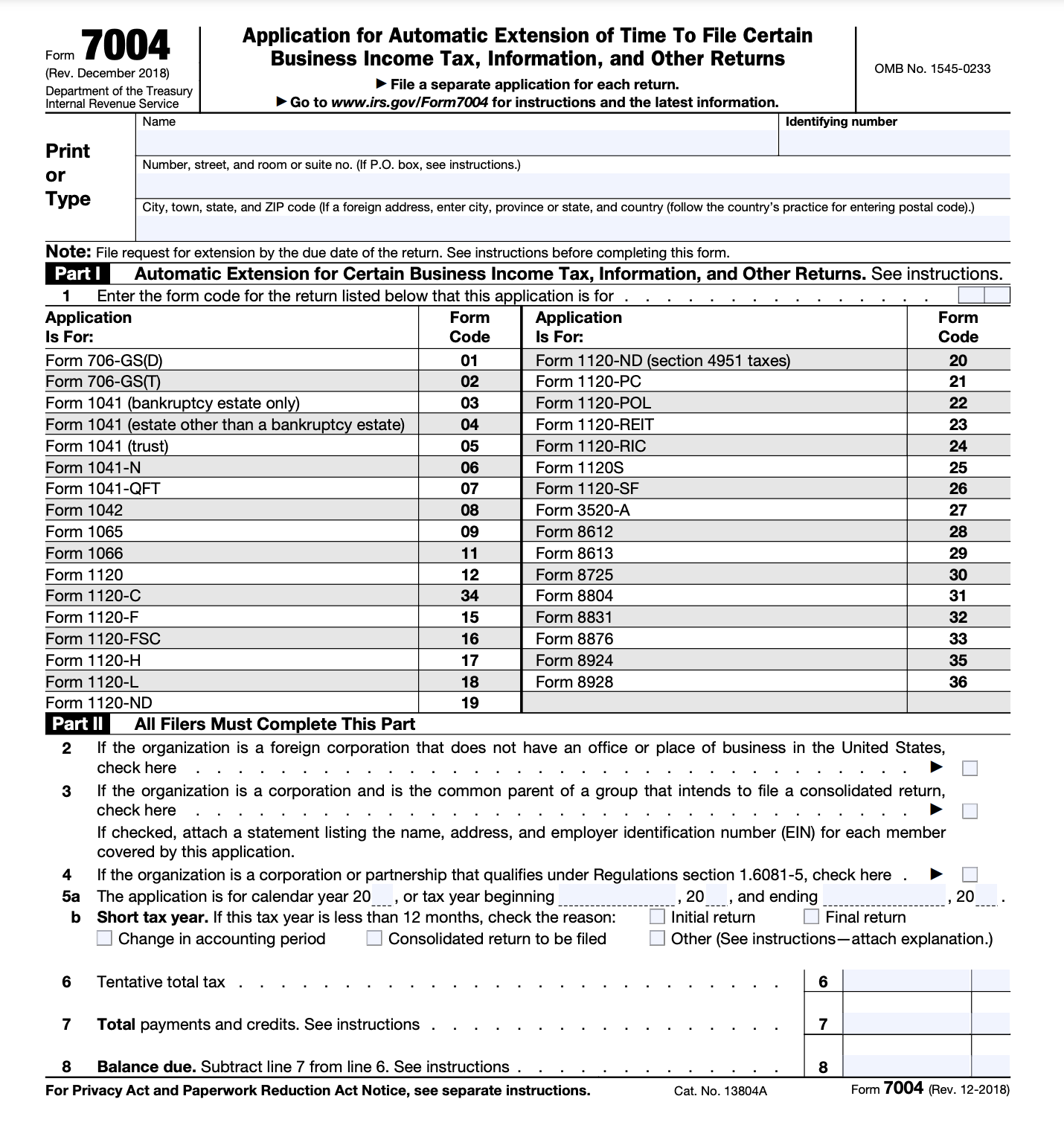

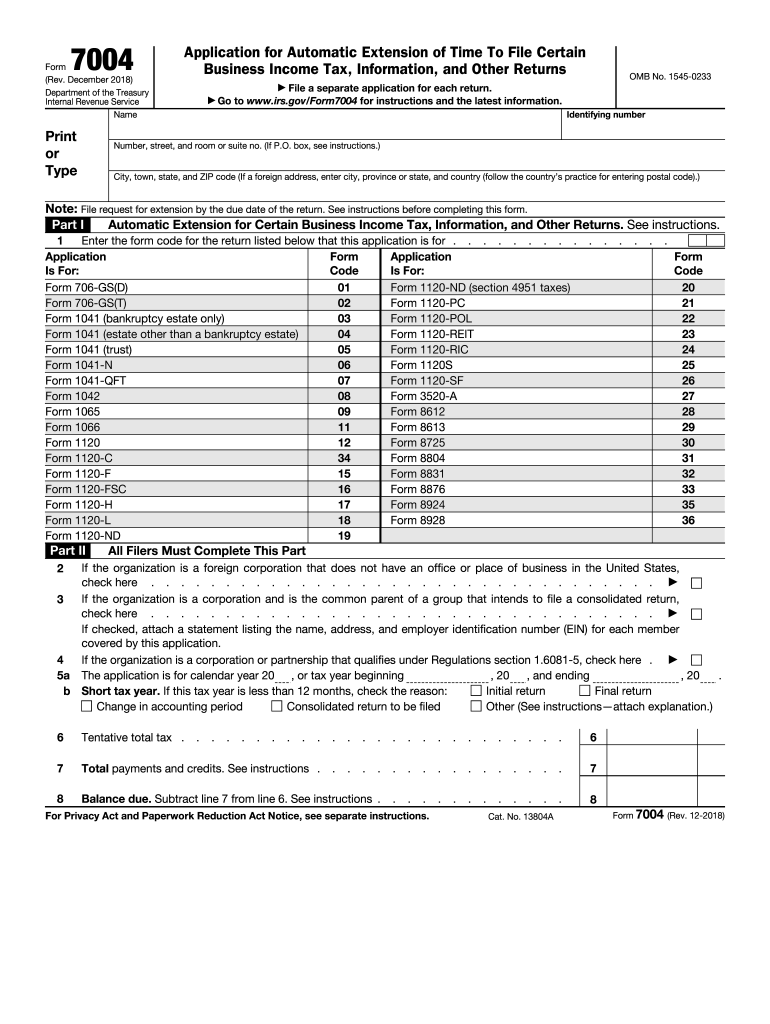

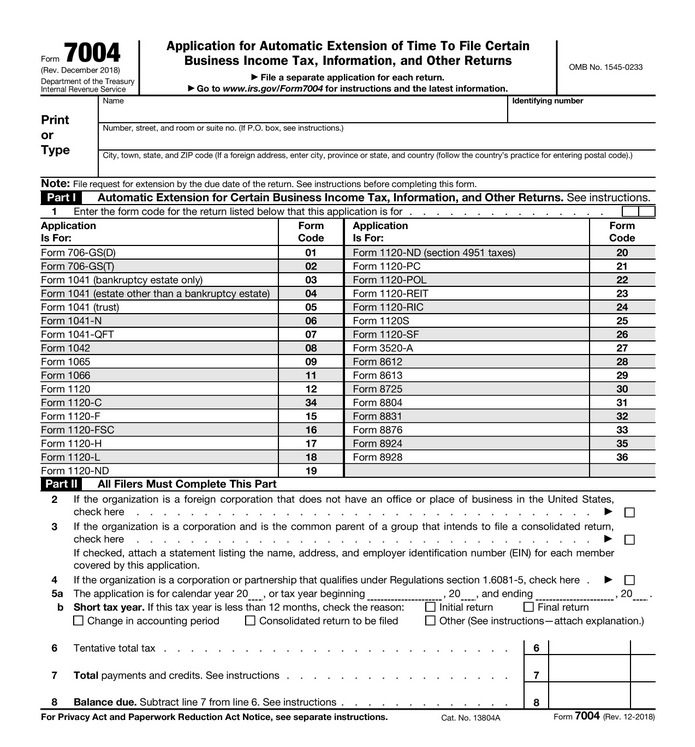

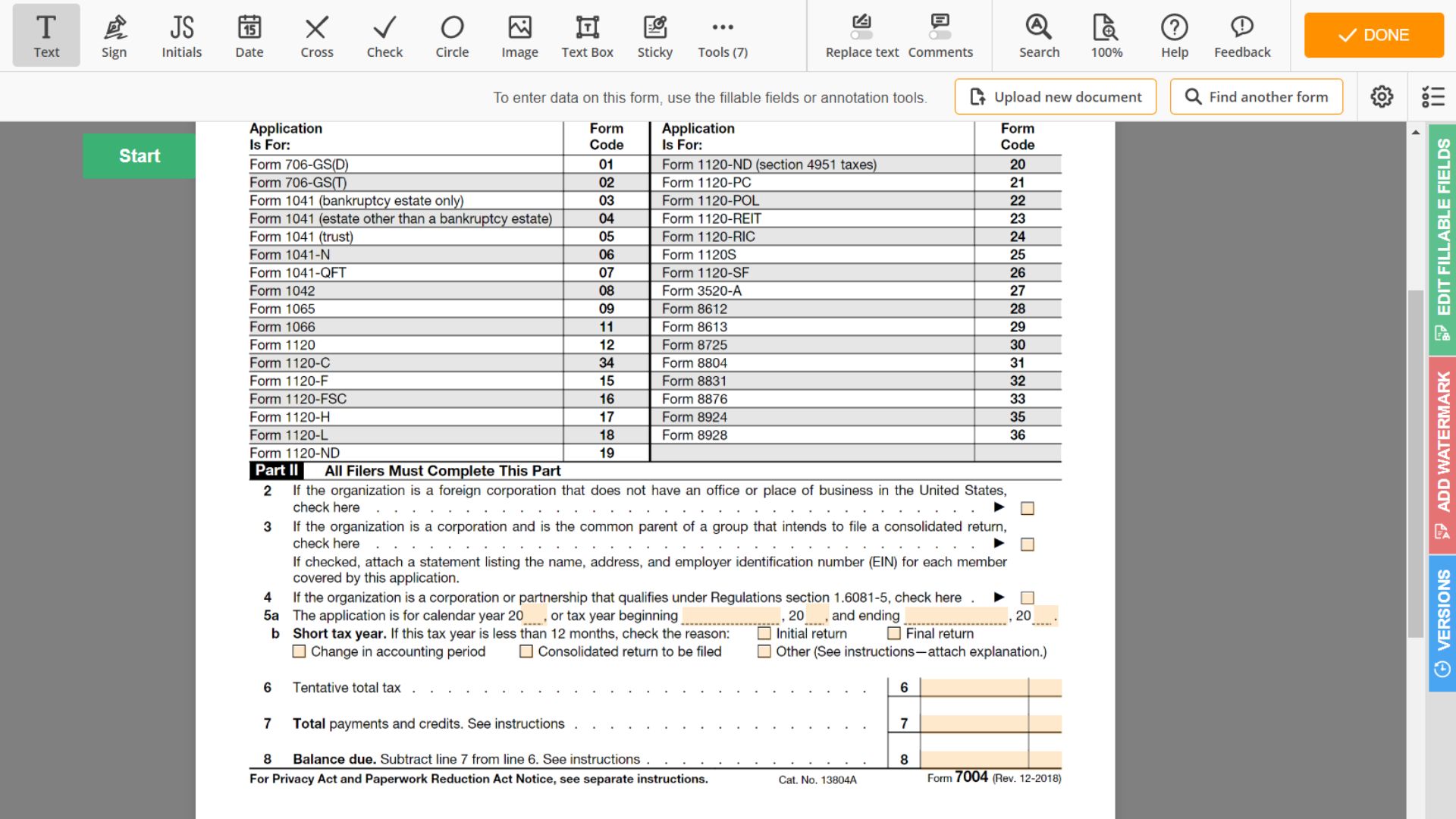

What is Form 7004 and How to Fill it Out Bench Accounting, If the due date falls on a weekend or a federal holiday, then the next business day will be the deadline for filing the extension. Corporations may use form 7004 to obtain an automatic.

Form 7004 Fill Out and Sign Printable PDF Template signNow, The deadline for filing form 7004 is on or before the due date of the tax return, for which the taxpayer is requesting an extension. Please remember that the irs doesn’t give extension time for tax payment;

How to Efile Form 7004 for Tax Year 2025 with ExpressExtension Blog, Irs form 7004 provides an extension for the filing deadline as follows: The deadline for individual tax returns without an extension, and also the last day to file form 4868 for an.

An Overview of Tax Extension Form 7004 Blog ExpressExtension, The due date for filing extensions on any federal income tax return is the due date of the tax return. An s corp can extend its filing deadline by six months if granted an extension by filing form 7004.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital, Businesses that want an extension can file form 7004 on or before the. The due date for filing extensions on any federal income tax return is the due date of the tax return.

An Easy Guide to Filing Form 7004 for your Business Blog, For sole proprietors and single member llcs, form 4868 is due. Filing form 7004 allows a business to extend the due date for its tax return, giving the business more time to prepare and file its tax return.

IRS Form 7004 📝 Federal Form 7004 Instructions for Tax Extension (2025, Deadline for s corporations and partnerships to request a tax extension via form 7004. For c corps and llcs taxed as corps, form 7004 is due, the submission date is april 15, 2025.

What Partnerships Need to Know About Form 7004 for Tax Year 2025 Blog, For sole proprietors and single member llcs, form 4868 is due. Generally, april 15th is the deadline for taxpayers filing for the calendar year.

IRS Form 7004 Automatic Extension for Business Tax Returns, The due date for filing extensions on any federal income tax return is the due date of the tax return. Use taxzerone's free form 7004 due date calculator to quickly determine your extended filing date for your business tax return.

Today is the Deadline to File a 2025 Form 7004 Extension Blog, These forms are due by april 15, 2025. 6 months (to september 16, 2025) for forms 1065, us return of partnership income and 1120s, us income tax return for.

You have 5 calendar days after the initial date when you transmit a 7004 extension electronic file to receive approval on a rejected extension.